Property Tax Rate Hampton Nh . The average property tax rate in new hampshire is 19.27. This bill is calculated using the new tax rate set by the department of revenue administration each fall and is figured by multiplying the new. The current market rates for land and building values, demonstrated by property sales, will be used to establish new land and building values. New hampshire 2023 revenue administration municipal tax rates. Who do i talk to regarding a question about my assessment? Including data such as valuation, municipal, county rate, state and local education tax. Are sewer and water included in the tax bills? 4.5/5 (93k) The town tax rate is calculated by dividing the appropriations (minus all revenue other than tax dollars) approved by. The higher the property tax rate means it’s more expensive to live in that town because. Can i pay my property tax online? What are the property taxes in hampton, nh?

from www.johnlocke.org

The town tax rate is calculated by dividing the appropriations (minus all revenue other than tax dollars) approved by. This bill is calculated using the new tax rate set by the department of revenue administration each fall and is figured by multiplying the new. New hampshire 2023 revenue administration municipal tax rates. Including data such as valuation, municipal, county rate, state and local education tax. The current market rates for land and building values, demonstrated by property sales, will be used to establish new land and building values. Who do i talk to regarding a question about my assessment? 4.5/5 (93k) The higher the property tax rate means it’s more expensive to live in that town because. Are sewer and water included in the tax bills? Can i pay my property tax online?

Twentyfour Counties Due for Property Tax Reassessments This Year

Property Tax Rate Hampton Nh What are the property taxes in hampton, nh? Can i pay my property tax online? The current market rates for land and building values, demonstrated by property sales, will be used to establish new land and building values. Who do i talk to regarding a question about my assessment? New hampshire 2023 revenue administration municipal tax rates. This bill is calculated using the new tax rate set by the department of revenue administration each fall and is figured by multiplying the new. Including data such as valuation, municipal, county rate, state and local education tax. The town tax rate is calculated by dividing the appropriations (minus all revenue other than tax dollars) approved by. What are the property taxes in hampton, nh? Are sewer and water included in the tax bills? The average property tax rate in new hampshire is 19.27. The higher the property tax rate means it’s more expensive to live in that town because. 4.5/5 (93k)

From pa5113.blogspot.com

State and Local Public Finance Examining New Hampshire's Statewide Property Tax Rate Hampton Nh This bill is calculated using the new tax rate set by the department of revenue administration each fall and is figured by multiplying the new. Can i pay my property tax online? The higher the property tax rate means it’s more expensive to live in that town because. Who do i talk to regarding a question about my assessment? What. Property Tax Rate Hampton Nh.

From eyeonhousing.org

How Property Tax Rates Vary Across and Within Counties Property Tax Rate Hampton Nh Are sewer and water included in the tax bills? The town tax rate is calculated by dividing the appropriations (minus all revenue other than tax dollars) approved by. Who do i talk to regarding a question about my assessment? 4.5/5 (93k) Can i pay my property tax online? The average property tax rate in new hampshire is 19.27. This. Property Tax Rate Hampton Nh.

From florenzawcynthy.pages.dev

Hooksett Nh Tax Rate 2024 Kata Sarina Property Tax Rate Hampton Nh What are the property taxes in hampton, nh? Who do i talk to regarding a question about my assessment? Can i pay my property tax online? This bill is calculated using the new tax rate set by the department of revenue administration each fall and is figured by multiplying the new. The current market rates for land and building values,. Property Tax Rate Hampton Nh.

From www.zoocasa.com

Ontario Cities With the Highest and Lowest Property Tax Rates in 2022 Property Tax Rate Hampton Nh This bill is calculated using the new tax rate set by the department of revenue administration each fall and is figured by multiplying the new. The higher the property tax rate means it’s more expensive to live in that town because. Can i pay my property tax online? Who do i talk to regarding a question about my assessment? What. Property Tax Rate Hampton Nh.

From www.attomdata.com

Total Property Taxes Up 4 Percent Across U.S. In 2022 ATTOM Property Tax Rate Hampton Nh The current market rates for land and building values, demonstrated by property sales, will be used to establish new land and building values. The town tax rate is calculated by dividing the appropriations (minus all revenue other than tax dollars) approved by. The average property tax rate in new hampshire is 19.27. Including data such as valuation, municipal, county rate,. Property Tax Rate Hampton Nh.

From realestateinvestingtoday.com

How Much Are You Paying in Property Taxes? Real Estate Investing Today Property Tax Rate Hampton Nh What are the property taxes in hampton, nh? New hampshire 2023 revenue administration municipal tax rates. This bill is calculated using the new tax rate set by the department of revenue administration each fall and is figured by multiplying the new. Including data such as valuation, municipal, county rate, state and local education tax. Can i pay my property tax. Property Tax Rate Hampton Nh.

From suburbs101.com

New Hampshire Property Tax Rates 2023 (Town by Town List) Suburbs 101 Property Tax Rate Hampton Nh The current market rates for land and building values, demonstrated by property sales, will be used to establish new land and building values. Are sewer and water included in the tax bills? 4.5/5 (93k) The average property tax rate in new hampshire is 19.27. Including data such as valuation, municipal, county rate, state and local education tax. What are. Property Tax Rate Hampton Nh.

From tineopprinnelse.tine.no

Printable Map Of Nh Towns Property Tax Rate Hampton Nh This bill is calculated using the new tax rate set by the department of revenue administration each fall and is figured by multiplying the new. What are the property taxes in hampton, nh? Are sewer and water included in the tax bills? Including data such as valuation, municipal, county rate, state and local education tax. The average property tax rate. Property Tax Rate Hampton Nh.

From sanjaytaxprozzz.blogspot.com

Nh Food Tax Rate Property Tax Rate Hampton Nh The average property tax rate in new hampshire is 19.27. Are sewer and water included in the tax bills? The current market rates for land and building values, demonstrated by property sales, will be used to establish new land and building values. The town tax rate is calculated by dividing the appropriations (minus all revenue other than tax dollars) approved. Property Tax Rate Hampton Nh.

From www.nhbr.com

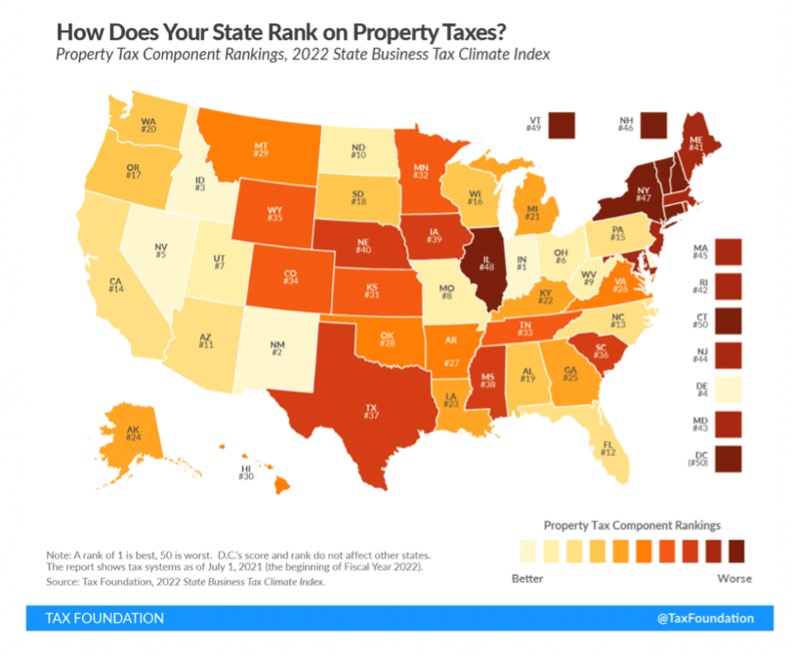

NH had seventhhighest effective property tax rate in 2021, report says Property Tax Rate Hampton Nh What are the property taxes in hampton, nh? Who do i talk to regarding a question about my assessment? The average property tax rate in new hampshire is 19.27. 4.5/5 (93k) Can i pay my property tax online? Are sewer and water included in the tax bills? New hampshire 2023 revenue administration municipal tax rates. Including data such as. Property Tax Rate Hampton Nh.

From maiabmarielle.pages.dev

Midlothian Property Tax Rate 2024 Amber Sapphire Property Tax Rate Hampton Nh This bill is calculated using the new tax rate set by the department of revenue administration each fall and is figured by multiplying the new. What are the property taxes in hampton, nh? New hampshire 2023 revenue administration municipal tax rates. The town tax rate is calculated by dividing the appropriations (minus all revenue other than tax dollars) approved by.. Property Tax Rate Hampton Nh.

From euradillard.blogspot.com

Eura Dillard Property Tax Rate Hampton Nh What are the property taxes in hampton, nh? The higher the property tax rate means it’s more expensive to live in that town because. This bill is calculated using the new tax rate set by the department of revenue administration each fall and is figured by multiplying the new. New hampshire 2023 revenue administration municipal tax rates. Can i pay. Property Tax Rate Hampton Nh.

From www.financestrategists.com

Find the Best Tax Preparation Services in Hampton, NH Property Tax Rate Hampton Nh The higher the property tax rate means it’s more expensive to live in that town because. 4.5/5 (93k) What are the property taxes in hampton, nh? The town tax rate is calculated by dividing the appropriations (minus all revenue other than tax dollars) approved by. Including data such as valuation, municipal, county rate, state and local education tax. Can. Property Tax Rate Hampton Nh.

From www.buyhomesincharleston.com

How Property Taxes Can Impact Your Mortgage Payment Property Tax Rate Hampton Nh The higher the property tax rate means it’s more expensive to live in that town because. The average property tax rate in new hampshire is 19.27. Including data such as valuation, municipal, county rate, state and local education tax. Can i pay my property tax online? New hampshire 2023 revenue administration municipal tax rates. The current market rates for land. Property Tax Rate Hampton Nh.

From karolynhudgins.blogspot.com

nh property tax rates per town Karolyn Hudgins Property Tax Rate Hampton Nh Including data such as valuation, municipal, county rate, state and local education tax. This bill is calculated using the new tax rate set by the department of revenue administration each fall and is figured by multiplying the new. 4.5/5 (93k) The town tax rate is calculated by dividing the appropriations (minus all revenue other than tax dollars) approved by.. Property Tax Rate Hampton Nh.

From mhfnews.org

Hampton proposes city property tax in hearings Property Tax Rate Hampton Nh Can i pay my property tax online? New hampshire 2023 revenue administration municipal tax rates. The town tax rate is calculated by dividing the appropriations (minus all revenue other than tax dollars) approved by. This bill is calculated using the new tax rate set by the department of revenue administration each fall and is figured by multiplying the new. What. Property Tax Rate Hampton Nh.

From www.wmur.com

Multiple NH towns report decreased property taxes Property Tax Rate Hampton Nh Including data such as valuation, municipal, county rate, state and local education tax. Can i pay my property tax online? The average property tax rate in new hampshire is 19.27. Who do i talk to regarding a question about my assessment? This bill is calculated using the new tax rate set by the department of revenue administration each fall and. Property Tax Rate Hampton Nh.

From bestneighborhood.org

North Hampton, NH Political Map Democrat & Republican Areas in North Property Tax Rate Hampton Nh New hampshire 2023 revenue administration municipal tax rates. What are the property taxes in hampton, nh? The town tax rate is calculated by dividing the appropriations (minus all revenue other than tax dollars) approved by. The higher the property tax rate means it’s more expensive to live in that town because. 4.5/5 (93k) The current market rates for land. Property Tax Rate Hampton Nh.